For 10-years the Danish housing market has enjoyed inflatory growth rates, backed by changing administrations in an unholy alliance with the credit-unions, and a seemingly never-ending, and historically cheap, credit, the average to upper middle-class financed their escalating consumerism by “eating bricks” (i.e. taking out mortgages).

For 10-years the Danish housing market has enjoyed inflatory growth rates, backed by changing administrations in an unholy alliance with the credit-unions, and a seemingly never-ending, and historically cheap, credit, the average to upper middle-class financed their escalating consumerism by “eating bricks” (i.e. taking out mortgages).

Everybody knew it would end at some point, but what is the solution suggested by our politicians? Bail-out packages of historic proportions.

We can’t afford that people loose faith in “our” financial institutions.

Suddenly they’re ours? What has happened the last 10 years is that credit-giving has been based on the premisses that housing-prices will keep going up at super-inflatory rates, and when credit was running thin, we’ll just boost it by allowing people to take out mortgages where you only pay the interest.

This has led to the following:

- Higher prices, effectively baring first time buyers from owning a house

- No-one can afford to move, because the prices have skyrocketed, seriously limiting the flexibility of the workforce

- Now that prices have dropped, you’re left with huge monthly payments, that you can’t afford if you loose your job

Our financial institutions

The Danish financial market has undergone the biggest changes in more than 100 years over the last 10-20 years.

The Danish credit-unions was based on solidarity and they were owned by the mortgage-holders not the big banks, if you look at your mortgage payments, you’ll notice that you pay something called “bidrag”, these days it’s simply a fee, but it used to be called “reservefondsbidrag” (“reserve-fee”), and it was paid back to mortgage holders if the credit-union did have to dig into the reserves, read was running a healthy business.

Why the focus on stock prices?

Personally I don’t understand the huge focus on stock prices. The stock-market is highly volatile, and what is reported in the news is the stock index, which is an average based on a selected few of the major companies, the Danish stock-exchage index is called OMX-20, the 20 refers to the fact that only 20 of the listed companies are counted in the index.

The market cap of these 20 companies does indeed represent a huge percentage of the total market, but they’re also carefully selected based on the performance of the stock, and if one or a few of the 20 companies sneezes the market catches a cold.

The focus on stock-prices will only hit you if you sell, if the companies are healthy they will make a profit, and you’ll receive dividends

Mortgage 101: Why I sleep tight at night

My own mortgage is made up of 60% variable rate, and it’s refinanced every year. Right now it looks like I’ll have to pay .5% higher interest next year, but I think this might change and probably to the better. Why do I think so? The variable rate mortgages are financed by selling of bonds, and since we have a financial crisis that hits the stock market, bonds are in higher demand which means higher prices and thus lower interest rates.

The financial crisis also means that short-term bonds should be in higher demand, making the variable rate mortgages more attractive. But since the short-term bonds are less attractive for the credit-unions, they’re trying to convince the mortgage-owners to refinance or take out insurance, which will make them more money.

I’m keeping my variable-rate, short-term, mortgage.

Take back your financial institutions

I suggest that we go back and look at how the credit-unions originally were organised, owned by the mortgage-holders, based on solidarity and healthy loan giving.

The idea of people being able to finance their house is instrumental in improving the quality of life, a lot of people haven’t been able to afford this due to the inflatory prices and rampant mortgage-giving using creative and unhealty offers.

It’s time to take back our financial institutions and our lives, but also to stop the rampant consumerism and the irresponsible behaviour, that is helping destroy the planet.

The financial crisis: a control mechanism?

Personally I feelthink that the financial crisis is a “control mechanism” on the scale of “The Matrix”. It’s meant to scare us into fearing the future, and since we’ve taken out loans we can’t really afford to pay, driven by irresponsible lending politics, we’re forced to work even harder, and even remain active in the workforce for a longer period.

Hmm, this sounds exactly like what the OECD and The Danish Economic Council, and thus the Government, has prescribed.

Sources:

- Wikipedia contributors, “Subprime mortgage crisis,” Wikipedia, The Free Encyclopedia, http://en.wikipedia.org/w/index.php?title=Subprime_mortgage_crisis&oldid=243578283 (accessed October 7, 2008).

- Wikipedia contributors, “Dividend,” Wikipedia, The Free Encyclopedia, http://en.wikipedia.org/w/index.php?title=Dividend&oldid=242969435 (accessed October 7, 2008).

- Wikipedias brugere, “Realkreditinstitut,” Wikipedia, Den frie encyklopædi , http://da.wikipedia.org/w/index.php?title=Realkreditinstitut&oldid=1523746 (hentet oktober 7, 2008)

- De Økonomiske Råd – Vismænd: Alle skal spare op til pensionen

- Wikipedia contributors, “The Matrix,” Wikipedia, The Free Encyclopedia, http://en.wikipedia.org/w/index.php?title=The_Matrix&oldid=243566930 (accessed October 7, 2008).

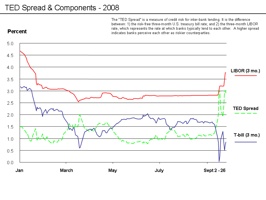

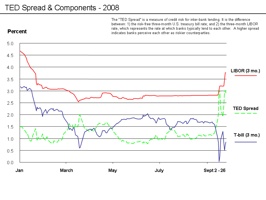

The image that is used above is taken from WikiMedia Commons and it shows the “TED spread”.

The “TED Spread†is a measure of credit risk for inter-bank lending. It is the difference between: 1) the risk-free three-month U.S. treasury bill rate; and 2) the three-month London Interbank Borrowing Rate (LIBOR), which represents the rate at which banks typically lend to each other. A higher spread indicates banks perceive each other as riskier counterparties. The t-bill is considered “risk-free” because the full faith and credit of the U.S. government is behind it; theoretically, the government could just print money so you will get your principal back at maturity.

From WikiMedia Commons (http://en.wikipedia.org/w/index.php?title=Image:TED_Spread_Chart_-_Data_to_9_26_08.png&oldid=243108019)